Coingape - 2/23/2021 8:40:19 AM - GMT (+0 )

Amid the marketwide bloodbath, the world’s second-largest cryptocurrency Ethereum (ETH) has tanked over 16% with its price slipping below $1600 levels. Two days back on Sunday, February 21, ETH price surged past $2000 levels. However, it has failed to sustain that high peak and has corrected 20% since then.

As ETH continues to face downward pressure, its on-chain network activity remains strong. On-chain data provider Santiment notes that despite the recent pullback, Ethereum’s “the rising trend of active addresses and new addresses created on the $ETH network remains evident. Buy opportunities may arise soon”.

📊 #Ethereum is back to a market price of $1,779, down 12.6% from its #ATH made Saturday. However, the rising trend of active addresses and new addresses created on the $ETH network remains evident. Buy opportunities may arise soon via our data signals. https://t.co/K1PCif0wFd pic.twitter.com/9qziZqDAoN

— Santiment (@santimentfeed) February 22, 2021

Thus, this might be a potential buying opportunity for fresh investors or those who missed the early-year rally. As we know, that the Grayscale Ethereum Trust (ETHE) has been heavily scooping up ETH supplies since the start of February 2021. When ETH was trading over its existing price, Grayscale purchased over 160,000 ETH coins as per data on Bybt.

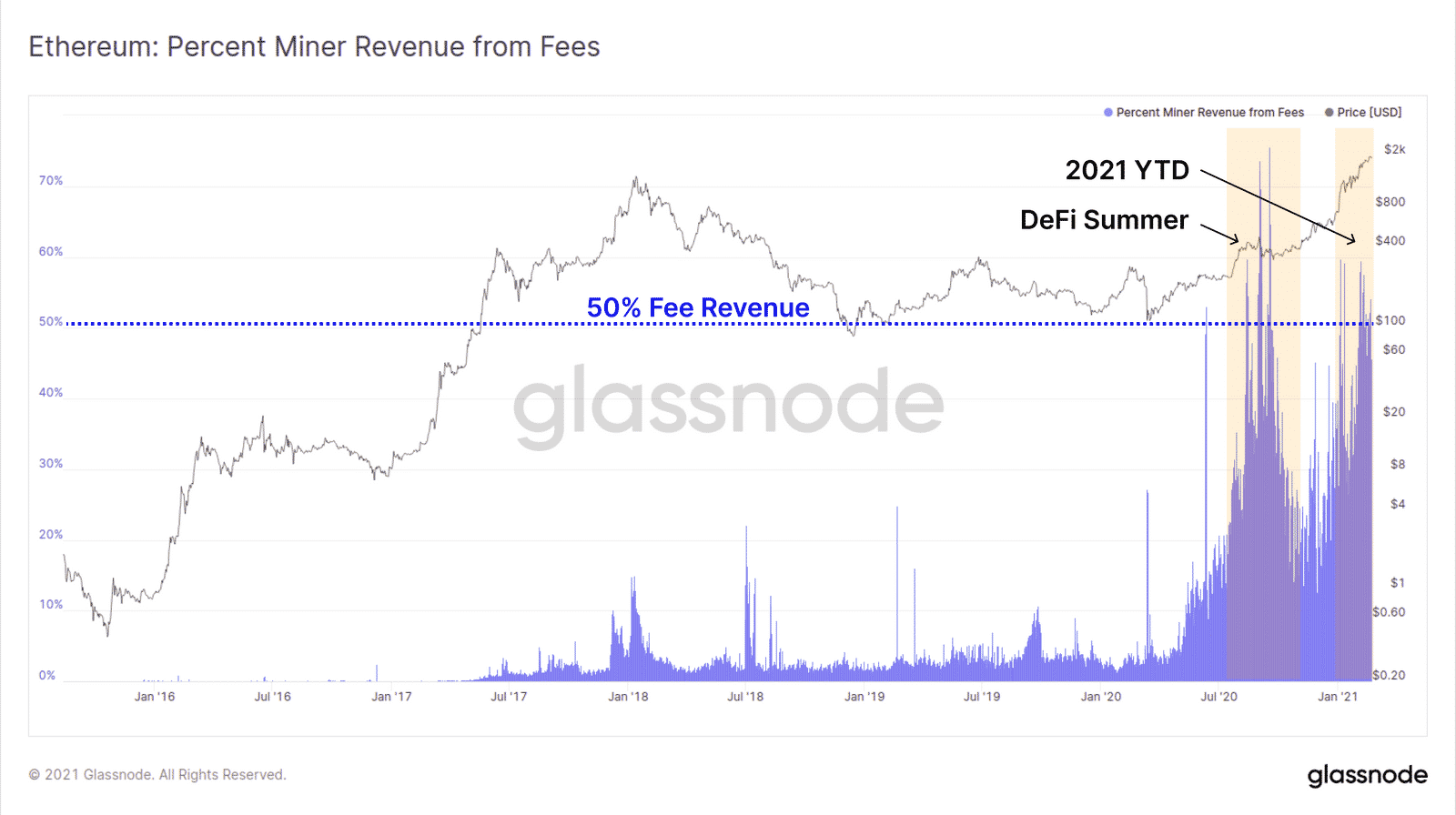

ETH Gas Fee Causing Trouble With surge In Mining RevenuesThe rapid surge in ETH gas fee has been a matter of concern for most investors. On Monday, February 22, the ETH gas fee spiked above 1200 gwei. Also, with the rapid surge in the DeFi activity, the ETH network activity remains very high.

As on-chain data provider Glassnode reports, the Ethereum transaction fee has sustained over 50% share of the total block rewards during two major DeFi bull runs. The Glassnode report states:

“It is no secret that Ethereum fees have been on the rise. Ultimately, this can be considered a vote of confidence that users are willing to pay a premium for inclusion in a block. Users will pay a high fee so long as the value of the transaction is outcome is profitable relative to the fee paid”.

As per our recent report from CoinGape, ETH price breakdown to $1500 is imminent ahead. But as said, any levels below $1600 present a good buying opportunity for the long term.

To keep track of DeFi updates in real time, check out our DeFi news feed Here.

read more