Coingape - 10/7/2019 3:48:07 PM - GMT (+0 )

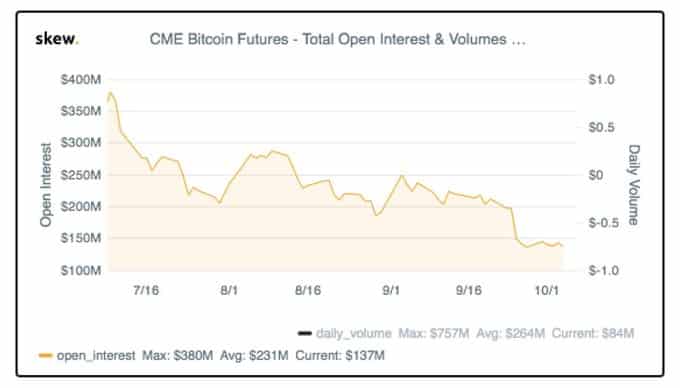

A recent tweet by the market analysis platform, Skew markets suggests that open interest at the Chicago Mercantile Exchange has decreased by 50%, thus, implying a decrease in spot price and volumes.

Spot trading volume has served as a lagging indicator of price. This implies that as the prices increase, more people start trading and thus the volume goes up. While this has been the case, the case of the Chicago Mercantile Exchange makes up for an interesting case scenario. Also, the recent report by Commitment of Traders(COT) reports that a significant amount of contracts were left to expire before September.

Source- TwitterAccording to a research report from Arcane Crypto, there is a clear correlation between contract settlement and negative intraday Bitcoin returns. The report further suggests that since January 2018, on average, bitcoin falls 2.27% as it approaches the CME expiration date.

Source- Arcane CryptoBendeik Norheim Skei, an analyst said the previous week

“Traders that hold both a short position on CME and a long position somewhere else can sell their long position, and stay in the futures contract (that is a short position), and then get a profit from the drop they created when selling the bitcoin in the spot market. As there is a lot of algo trading in the market, traders might speculate that a dump of a relatively large long position might offset a ratchet effect, resulting in a larger price fall.”

While it is simply a hedging tactic or actual manipulation, an arbitrage opportunity comes forth as the settlement approaches. This thus allows traders to simultaneously long and shorts in varying markets.

Significant Drop-in Open Interest and Daily VolumesThe previous month recorded a 4-month low amid crashing BTC price. As per the charts which show the relationship between CME’s open interest and daily volumes, there has been a significant fall in open interest from $384 million to the current value of $218 and daily volume has reduced from its maximum value of $1.726 billion to its current value at $86 million.

Source- Skew MarketsWill Bitcoin dip further? What will be the long term prospects of CME futures? Let us know what you think in the comments below!

Disclaimer The views, opinions, positions or strategies expressed by the authors and those providing comments are theirs alone, and do not necessarily reflect the views, opinions, positions or strategies of CoinGape. Do your market research before investing in cryptocurrencies. The author or publication does not hold any responsibility for your personal financial loss.

Coming from a physics background the unpredictability and intrigue of the cryptoverse attracted me to take a dive in this field. I am all eyes and ears for the latest trends in blockchain and crypto sphere. Whenever I am not writing or researching, I love to read sci-fi novels, play basketball and watch action movies. I strongly believe that blockchain and cryptocurrency will bring lasting transformations in people’s lives in the years to come. You can reach out to me at supriya [at] coingape.com.

read more