AMBCrypto - 1/31/2025 11:01:36 PM - GMT (+0 )

- Bitcoin-backed loans offer liquidity while preserving exposure to Bitcoin’s long-term price growth

- The “buy, borrow, die” strategy helps investors unlock value, without triggering tax events

An increasing number of Bitcoin [BTC] holders are finding ways to access liquidity without selling their assets or triggering tax events. Bitcoin-backed loans are at the forefront of this shift, allowing investors to borrow against their BTC while retaining ownership.

In fact, market analyst Mark Harvey is among those who have emphasized the “buy, borrow, die” strategy as a sustainable approach to wealth management. This offers long-term income streams, while preserving exposure to Bitcoin’s future price growth.

This innovative method is quickly gaining traction among investors looking to maximize the utility of their digital assets, while minimizing tax implications.

Unlocking Bitcoin’s value without sellingHarvey’s latest proposal suggests using Bitcoin as collateral to secure loans, enabling holders to access liquidity while retaining exposure to Bitcoin’s price growth.

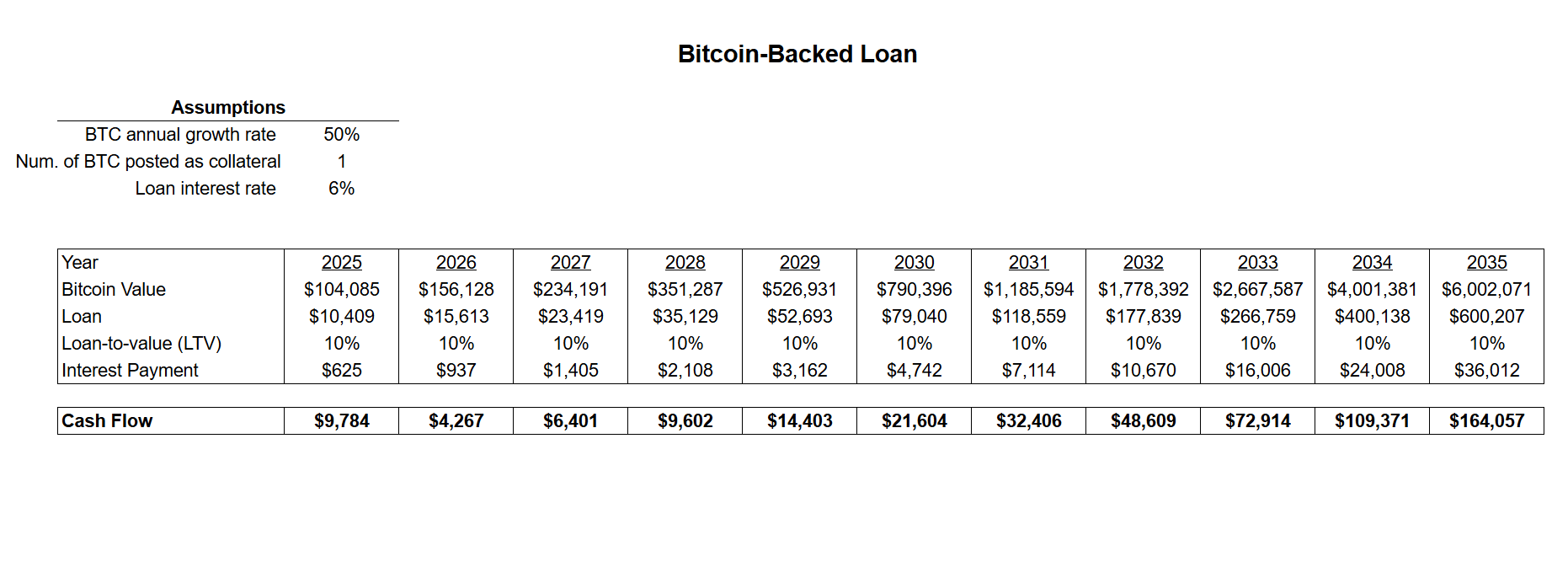

With a 10% loan-to-value (LTV) ratio, 1 BTC as collateral can unlock increasing loan amounts annually, assuming Bitcoin appreciates by 50% per year. Borrowers roll over loans into larger amounts each year, accessing more capital without triggering taxable events.

This strategy allows investors to benefit from Bitcoin’s long-term value growth, while generating spendable income through loan proceeds – Eliminating the need to sell their Bitcoin.

Bitcoin loans – Cash flow benefitsThe Bitcoin-backed loan strategy offers significant cash flow advantages. Initially, with a single Bitcoin valued at approximately $104,085, an investor can borrow $10,409 and generate a cash flow of $9,784 after paying interest.

As Bitcoin appreciates, both the loan amount and cash flow grow. By 2035, with BTC projected to be worth over $6 million, the loan amount reaches $600,207, yielding an impressive $164,057 in annual cash flow.

This approach transforms Bitcoin from a passive asset into an income-generating tool, allowing investors to sustain their lifestyles or reinvest funds without selling their holdings. The ability to roll over loans annually ensures continuous access to liquidity, making this a powerful strategy for long-term financial security.

Wealth generation – The ‘buy, borrow, die’ strategyThe ‘buy, borrow, die’ strategy leverages Bitcoin-backed loans for wealth preservation and tax efficiency. Investors borrow against Bitcoin’s appreciating value, deferring capital gains taxes indefinitely.

Loan proceeds remain untaxed, and heirs inherit Bitcoin at a stepped-up cost basis, potentially eliminating taxes. By rolling loans into larger amounts, this approach ensures liquidity, maximizes Bitcoin’s growth potential, and secures a tax-efficient financial legacy.

Read Bitcoin’s [BTC] Price Prediction 2025–2026

Criticism and risks

While the idea of Bitcoin-backed loans sounds promising, not everyone agrees. Critics argue that this model relies too much on speculation and factors outside of an investor’s control.

One Twitter user warned,

“This always looks amazing on paper, in reality (from personal experience cough BlockFi) it doesn’t work this way.”

The collapse of lending platforms like BlockFi has made some skeptical of over-leveraging BTC. Others challenge the assumption that Bitcoin will appreciate by 50% annually, with one user pointing out,

“If it would go up 50% after just 10 years BTC price should be like 5 million dollars… your 50% must stop at some point mathematically speaking.”

There’s also concern over whether the initial loan amounts justify the risk, as another critic noted,

“In 2025, $10,409 doesn’t buy much. Seems not worth the risk.”

These counterpoints highlight that while Bitcoin-backed loans offer potential, they also carry risks tied to BTC’s volatility, lender stability, and market unpredictability.

read more