Our Bitcoin News - 3/25/2023 12:16:41 AM - GMT (+0 )

- NY Dow: $32,237 +0.4%

- Nasdaq: $11,823 +0.3%

- Nikkei Stock Average: ¥27,385 -0.1%

- USD/JPY: 130.7 -0.06%

- US dollar index: 103.1 +0.5%

- 10 year US Treasury yield: 3.37 -0.9% annual yield

- Gold Futures: $1,981 -0.7%

- Bitcoin: $27,553 -2.7%

- Ethereum: $1,756 -3.7%

traditional finance

crypto assets

Today’s NY Dow continued to rise slightly and closed at +132 dollars. The Nasdaq also rose and closed at +36 dollars.

Deutsche Bank problem

In the morning of the 24th, Germany’s largest financial institution, Deutsche Bank, announced that it would redeem some of its corporate bonds early, but the stock price of the bank plunged by more than 14% at one point. It became a material to heighten the credit anxiety of the people, and led to the sale of regional bank stocks.

Deutsche Bank has proposed redeeming the junior bonds at face value on the same day to restore confidence after Swiss regulators decided to mark the value of Credit Suisse AT1 (bail-in) bonds at zero. bottom. Even after UBS’s takeover of Credit Suisse last weekend, it seems that concerns about the spread of financial system instability have not yet been dispelled.

The Stoxx 600 Banks index hit a five-year high in February, but has since fallen sharply following the bankruptcy of SVB Bank.

Source: investing.com

Deutsche Bank’s five-year credit default swaps (CDS), which take into account the risk of default, climbed to more than 2.2%, the highest since 2018, according to Reuters. Meanwhile, German Chancellor Scholz publicly expressed his trust in Deutsche Bank by describing it as a “very profitable bank” to reporters.

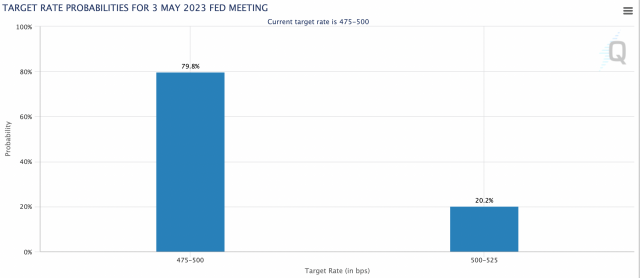

Expectations to stop rate hikes rising

After Thursday’s FOMC interest rate announcement, Powell ruled out a rate cut later this year, but some markets are still hopeful that financial turmoil and recession will eventually force rate cuts. seems to be In the US interest rate swap market, the expectation of an interest rate hike in May is disappearing, as confidence in banks is likely to collapse. In addition, the possibility that the interest rate cut will start in June has resurfaced.

Source: CME

US Treasury Secretary Janet Yellen also called the heads of the US financial regulators for an emergency meeting of the Financial Stability Oversight Council (FSOC) on Wednesday. FSOC members include heads of several regulators, including the Federal Reserve Board (Fed) and the Federal Deposit Insurance Corporation (FDIC). The meeting was closed to the public, and it’s not yet clear if a statement will be released after the meeting.

connection: Bitcoin decline, optimistic view retreats with FOMC Powell remarks and Yellen congressional testimony

President Bullard’s remarks

Hawkish St. Louis Fed President James Bullard said on Wednesday that the recent U.S. and European bank credit troubles have eased stress in the banking sector as regulators acted swiftly, according to Bloomberg. said the Fed would likely need to raise interest rates more than expected. He is non-voting President Bullard at this year’s FOMC meeting, but he should continue to keep inflation under control with appropriate monetary policy, he said.

US Composite Purchasing Managers Index (PMI)

The preliminary figure for the Composite Purchasing Managers Index (PMI) for March, announced by S&P Global on the 24th, was 53.3, the highest level since May last year. The service industry PMI (53.3) and the manufacturing industry PMI (49.3) both exceeded expectations in March, but the manufacturing industry PMI has been below the “50” level, which marks the turning point between economic expansion and contraction, for five consecutive months. It also shows the possibility that inflation will gradually slow down. On the other hand, demand in the service sector remains strong, and companies are said to have room to raise prices.

Chris Williamson, chief business economist at S&P Global Market Intelligence, said in a statement: “This demand has been resilient in the face of uncertainty caused by the recent tightening of interest rates and stress in the banking sector. It would be important for the Fed to scrutinize that.”

Economic indicators from this week onwards (Japan time)

- March 30, 21:30 (Thursday): U.S. October-December Quarterly Real Gross Domestic Product (GDP, Final Value) (Quarterly Change Annual Rate)

- March 31, 21:30 (Friday): U.S. February Personal Consumption Expenditure (PCE Core Deflator) (MoM/YoY)

connection: What is the US monetary policy meeting “FOMC” that attracts the attention of global investors | Easy-to-understand explanation

US stocksSome regional banks were initially sold due to the sharp drop in Deutsche Bank’s stock price, but sentiment seems to have improved slightly following remarks by German Chancellor Olaf Scholz and US Treasury Secretary Janet Yellen’s emergency convocation of the FSOC. Deutsche Bank -8.5%, Barclays -4.2%, BNP Paribas -5.2%, JPMorgan Chase -1.5%, Citigroup -0.7%, First Republic -1.3%, Bank of America +0.6%, Wells Fargo -1% ( The day before ratio).

IT/tech stocks are mixed. Compared to the previous day for individual stocks, NVIDIA -1.5%, c3.ai +1.5%, Big Bear.ai -2.5%, Tesla -0.9%, Microsoft +1%, Alphabet -0.1%, Amazon -0.5%, Apple +0.8% , Meta +0.8%.

connection: Stock investment recommended for virtual currency investors, representative virtual currency stocks of Japan and the United States “10 selections”

Cryptocurrency/Blockchain-related Stocks (Year-on-Year Change/Year-to-Week Change)- Coinbase|$67.8 (+2.3%/-9.5%)

- Block | $60.6 (-1.9%/-18%)

- MicroStrategy | $256 (-2.5%/-4%)

The US payment service block (formerly Square), which was targeted by hedge fund Hindenburg Research’s short position, fell sharply -18% this week.

connection: U.S. block company, stock price plummeted due to short selling report “Sloppy customer confirmation promotes fraud”

Binance trading failureBitcoin (BTC) broke below the $28,000 level once again, and partly dropped to $27,000.

Source: Binance

At 8:38 p.m. last night, Binance suspended spot trading and deposits and withdrawals for about two hours, citing a problem with its matching engine. Stocks such as Bitcoin were sold upon the announcement.

Initial analysis indicates matching engine encountered a bug on a trailing stop order (a weird one). Recovering. Est 30-120 min ish. Waiting for more precise ETA.

Deposits & withdrawals are paused as a SOP (standard operating procedure). #SAFU🙏 https://t.co/mvtGQ3JlMA

— CZ 🔶 Binance (@cz_binance) March 24, 2023

Concerns about exchange security resurfaced, but Binance’s CZ stressed that customer funds were safe, after which functionality was restored.

GM radio of the weekWe hosted GM Radio this Thursday. We invited Christian Casazza, who belongs to the ecosystem development department of Ocean Protocol’s core team, and Nicholas Scavuzzo, who belongs to the DeFi (decentralized finance) department, to talk about the future of the data market.

https://t.co/MORb3f36Vs

— CoinPost Global (We’re hiring!) (@CoinPost_Global) March 22, 2023

connection: “GM Radio” Joins “Ocean Protocol” aiming to capitalize data

Click here for last week’s radio archive.

https://t.co/FLUMQlajlf

— CoinPost Global (We’re hiring!) (@CoinPost_Global) March 17, 2023

read more