Coingape - 6/29/2020 3:26:21 PM - GMT (+0 )

In a violent shake-out of futures traders on BitMEX, the December futures index records a $1200 difference between lows and highs in less than 30 minutes.

The XBTZ20 contract on BitMEX set to expire on 25th December 2020, drops to $8500 beginning with the 5-minute candle at 12:55 Hours UTC. Within the next 30 minutes, the price touches the lows once again followed by a massive surge to tap $9772 highs.

According to datamish, over $664,800 longs were liquidated on BitMEX in the last hour. Given, the volatility on spot prices has been limited, one can assume that majority of the liquidations were influenced by the price action in December contracts.

XBT (DEC Futures)/USD 30-Minute Chart on BitMEX (Source: BitMEX)The move was targeting the leveraged long orders for the contracts, as it taps the lows twice with wicks, within a span of 15 minutes. However, according to trader, XC, it did not cause any liquidations and is a common occurrence,

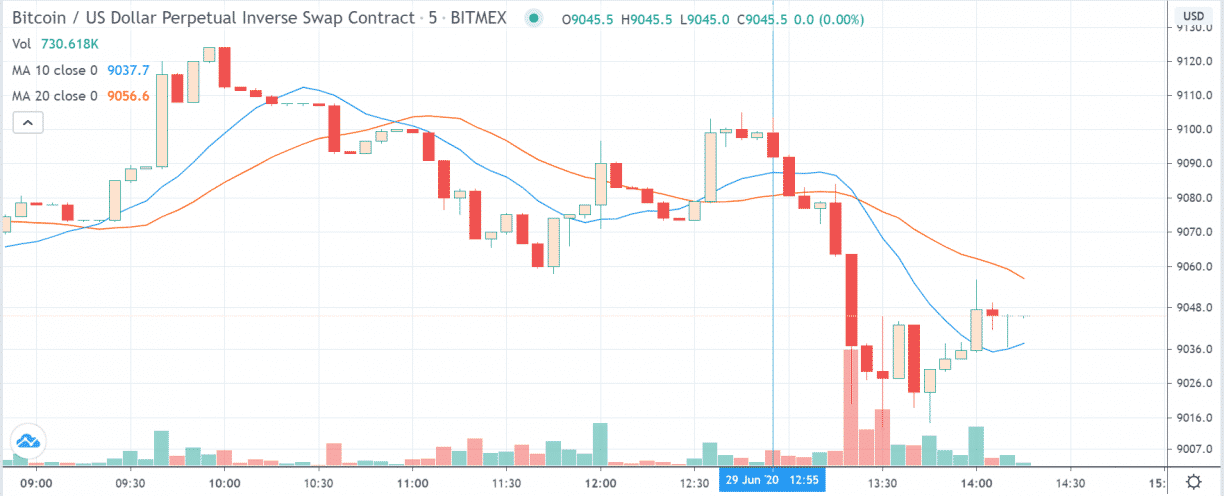

XTB (Dec Futures)/USD 5-Minute Chart on BitMEX Panic Sell-Off?0 liqs just a broken algo, has happened tons of times across various spots / futures markets.

Nevertheless, co-incidentally, on the perpetual swap markets, the drop seems to have initiated a quick sell-off to $901x. At press time, the price is trading at the mid-point, at a price of $9055.

The funding rate on BitMEX indicates neutral market sentiments towards Bitcoin, but a long inclination towards Ethereum.

XBT/USD 5-Minute Chart on BitMEX (TradingView)Despite valid explanations, the instances of market slippage and uncalled-for liquidations are seen far more often on BitMEX than other derivates platforms. The untethered leverage with high liquidity makes the platform highly lucrative for whale actions.

Lately, the Open Interest (OI) on Okex has been at par with BitMEX as well.

Bitcoin Futures Open Interest (Source: Skew)Be it broken algo or whale-sized orders, massive swings of such proportions make the investments in these contracts very risky. Moreover, it also strengthens the arguments against manipulation which further delays the regulatory progress.

Lately, traditional markets have seen violent swings as well. Which markets do you think are more organic: Crypto, Equities or Commodities? Please share your views with us.

Disclaimer The views, opinions, positions or strategies expressed by the authors and those providing comments are theirs alone, and do not necessarily reflect the views, opinions, positions or strategies of CoinGape. Do your market research before investing in cryptocurrencies. The author or publication does not hold any responsibility for your personal financial loss.

Nivesh from Engineering Background is a full-time Crypto Analyst at Coingape. He is an atheist who believes in love and cultural diversity. He believes that Cryptocurrency is a necessity to deter corruption. He holds small amounts of cryptocurrencies. Faith and fear are two sides of the same coin. Follow him on Twitter at @nivishoes or mail him at nivesh(at)coingape.com

read more