Coingape - 3/23/2020 12:26:21 PM - GMT (+0 )

The market is anxious. Bulls are weak and for Bitcoin traders, their eyes are fixed on the $5,300-400 zone.

A region of strong support, observers now say $5,300 should hold for BTC for bulls to have a chance of bouncing back to $6,000.

$5,300: The Make or Break Level for BitcoinBut it’s hard for bulls to remain optimistic as the financial markets across the board fall as coronavirus sparks an economic crisis, especially in Europe and the United States.

There are individuals who are not convinced with what is done and project the current crisis to worsen despite helicopter money and the US FED taking extreme and even risky measures to salvage what appears to be an inevitable collapse.

Over $500 billion has been minted and the upper-middle-class set to receive $1,200, inflation should ideally be another reason for Bitcoin and safe havens to flourish but its increasingly hard for bulls to overcome the wave of sell pressure.

As such, that $5,300 is a vital low that must stand for Bitcoin to soar holds true:

Sentiment remains Bearish“$5300-5400 was a strong level last week, hence I expect that to be tested first, with movements back to $6000-6200 max in between. US situation will worsen, question how markets react, and how much BTC correlates.”

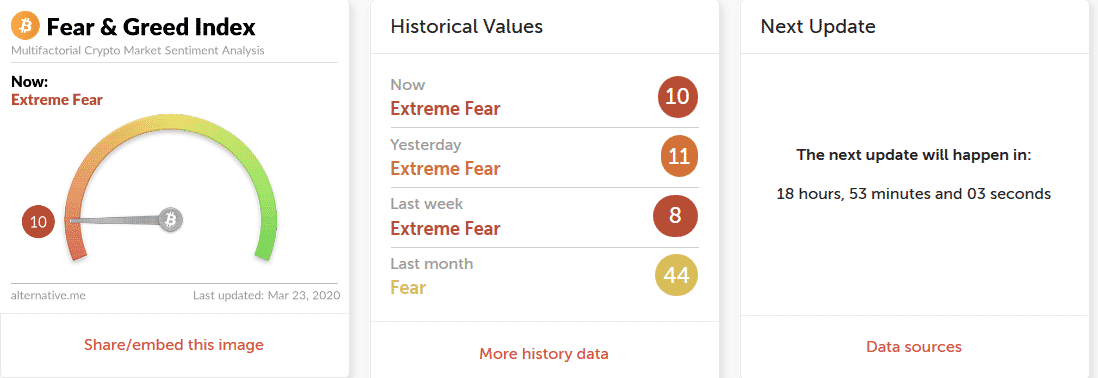

In all this, the prevailing sentiment is overwhelmingly bearish, and analysts are concerned.

#bitcoin sentiment very low but it has been worse as recently as early 2018. In the past, low sentiment preceded large rallies like we are seeing today. pic.twitter.com/pw7T1A4ChX

— Timothy Peterson (@nsquaredcrypto) March 19, 2020

On the bright side, people are concentrating more on Bitcoin, and topics relating it to other assets is at a 6-months low. This, according to TIE, “leads upwards price movement”.

“30 day average tweet volume on Bitcoin has hit a 6 month high (dotted line) as 30 day average sentiment score (bold line) has hit a 6 month low. Historically, we have seen that high tweet volume with low sentiment tends to lead upwards price movement.”

30 day average tweet volume on bitcoin has hit a 6 month high (dotted line) as 30 day average sentiment score (bold line) has hit a 6 month low.

Historically we have seen that high tweet volume with low sentiment tends to lead upwards price movement.

*Not investment advice* pic.twitter.com/CNxEoobrr4

— The TIE (@TheTIEIO) March 17, 2020

Going forward, the investment community remains apprehensive and as caution prevails, most are on the sidelines waiting for price recoveries before committing.

Crypto Fear Greed-Index Bitcoin Sentiment-Alternative-meThis wave of caution is amid news that the Bitmain Antminer S-9 are been rendered obsolete as at current prices most are struggling to remain in the green.

Disclaimer The views, opinions, positions or strategies expressed by the authors and those providing comments are theirs alone, and do not necessarily reflect the views, opinions, positions or strategies of CoinGape. Do your market research before investing in cryptocurrencies. The author or publication does not hold any responsibility for your personal financial loss.

Dalmas is a very active cryptocurrency content creator and highly regarded technical analyst. He’s passionate about blockchain technology and the futuristic potential of cryptocurrencies and enjoys the opportunity to help educate bitcoin enthusiasts through his writing insights and coin price chart analysis. Follow him at @dalmas_ngetich

read more