Coingape - 1/14/2020 4:48:31 AM - GMT (+0 )

The rising tension between US and Iran in the beginning of 2020 caused an uptrend in Bitcoin [BTC] and gold. However, Gold suffered it’s first blow as American leaders called off the potential war with Iran as the price dipped below $1550.

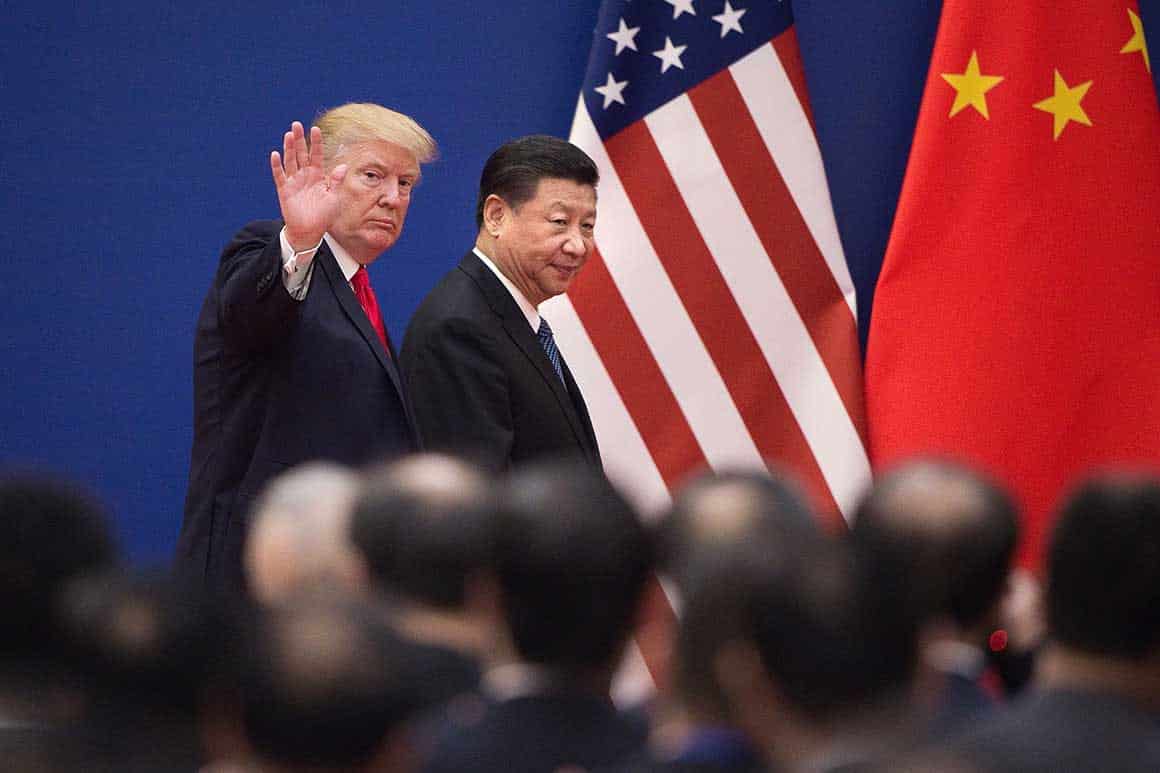

Now, an economic trade deal with China further strengthens investor confidence to take risk on stocks. Gold price drops back to the levels before the US air-strike. At press time, an ounce of Gold is trading at $1538.

Gold/USD 1-Day Chart (TradingView)The phase of the trade deal is due Wednesday 14th January and it looks like that the markets have already set the momentum for it.

The two countries will agree to a series of commitments like reducing tariffs and removing certain restrictions to grow business between the leading economies.

All is Not Fine with the EconomyNevertheless, the effects of the trade deal will not have any significant effect on the economy at large.

The rising national debt of the US and other worrying signals poses a big threat to the global economy. Gold buff and crypto critic, Peter Schiff tweeted this morning,

The actual national debt grew by over $1.2 trillion in 2019. That’s just over $100 billion per month. The rise in 2020 will be even greater. If we really had a good economy, the deficits would be getting smaller, not larger.

Moreover, financial and crypto analyst, Mati Greenspan, points out that the mortgage defaults which caused the downfall of the economy in 2007 is back above ATH levels as well. He tweeted,

https://twitter.com/MatiGreenspan/status/1216725655355887616

This along with the rising national debt is an alarming signal that was tripped last year. Nevertheless, the quantitative easing and positive political developments with China has kept the adversity at bay. The stocks soared to new highs on Monday ahead of the trade deal. The S&P 500 index is at $3288 at press time.

Furthermore, the correlation of Bitcoin with gold and events affecting global economy points to a downtrend. However, other fundamentals like Halving along with positive technical analysis seems to be pushing the price up.

BTC/USD 1-Day Chart on Coinbase (TradingView)The price of Bitcoin at 4: 30 hours UTC on 14th January 2019 is $8531. It is currently held between the 100-Day and 200-Day moving average at $7950 and $9100 respectively.

Do you think the trade deal would affect the price of Bitcoin? Please share your views with us.

Disclaimer The views, opinions, positions or strategies expressed by the authors and those providing comments are theirs alone, and do not necessarily reflect the views, opinions, positions or strategies of CoinGape. Do your market research before investing in cryptocurrencies. The author or publication does not hold any responsibility for your personal financial loss.

Nivesh from Engineering Background is a full-time Crypto Analyst at Coingape. He is an atheist who believes in love and cultural diversity. He believes that Cryptocurrency is a necessity to deter corruption. He holds small amounts of cryptocurrencies. Faith and fear are two sides of the same coin. Follow him on Twitter at @nivishoes or mail him at nivesh(at)coingape.com

read more