Coingape - 1/13/2020 3:38:21 AM - GMT (+0 )

Bitcoin [BTC] has been holding its bullish sentiments with a 11% positive weekly close at $8180. The levels above $7,800 are beginning to establish a new range with resistances at $8200 and $8375.

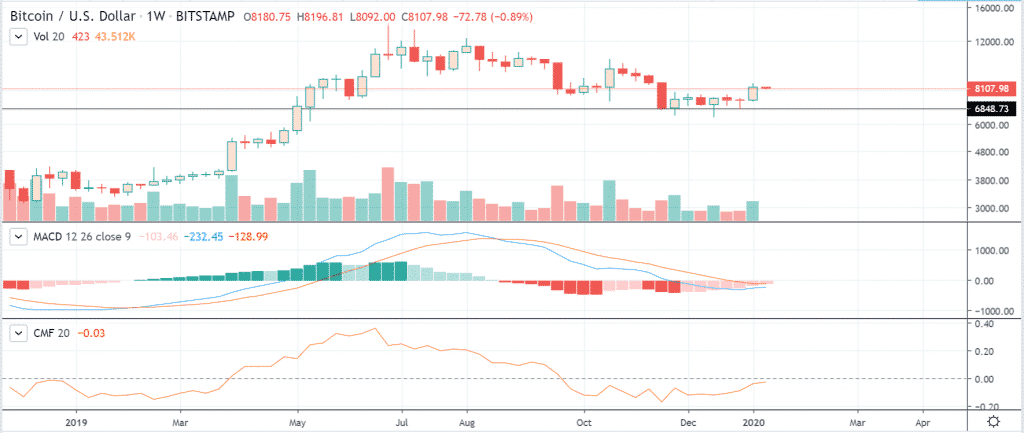

The oscillators like MACD and CMF on weekly are now starting to reach reversal points. They have been positive on the lower time frames since quite some time. Hence, Technical Analysis is currently strongly inclined bullish with positive fundamentals.

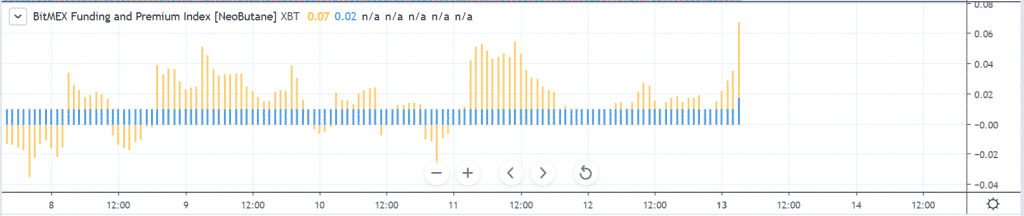

Futures Traders SentimentsOn BitMEX, the traders are looking bullish as the funding and premium is positive as BTC continues to hold above $8000. According to leading analysts like David Puell, Willy Woo, and others this is potential negative signals, as in history whales have been known to cause squeeze of the average traders.

BitMEX Funding Rate Hourly ChartOn Okex as well, the market sentiments is positive positive funding rate and BTC bias. Moreover, on Okex and Huobi, the Open Interest in Bitcoin is rising again.

Furthermore, on Huobi seems like large whales are holding on to the bullish side as the number of accounts are predominantly short. However, the over-all position is still in favor of bulls.

Chart 1: Shows the over-all Position on HoubiChart 2: Shows the Percentage of Accounts’ Position on Huobi But, Bullish Alarm Number 2 Goes Off

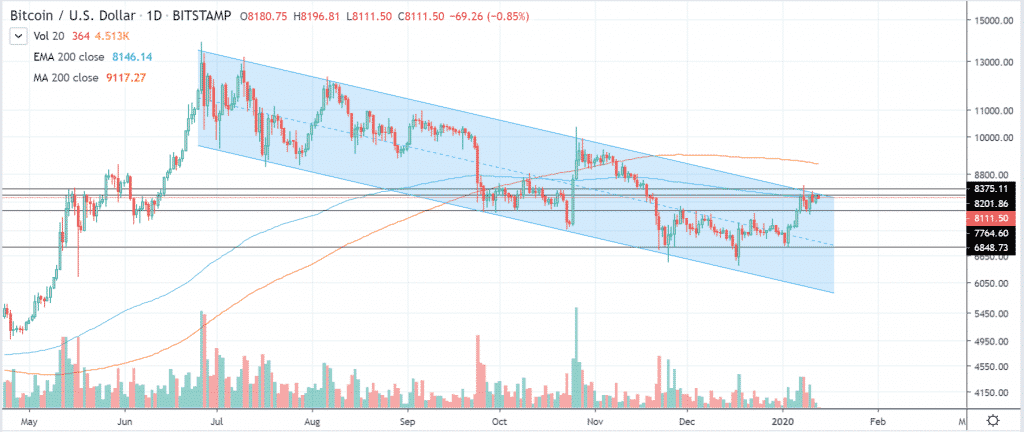

Bitcoin [BTC] has been macro bearish since September 2018, the bearish descending channel is the major trend in Bitcoin currently. The recent bullish moves in Bitcoin [BTC] broke attempted to break above the channel, the bulls only accomplished wicks on the upside.

BTC/USD 1-Day Chart on Bitstamp (TradingView)As reprted earlier on CoinGape, leading chart analyst Peter Brandt listed 4 criteria for a long term bullish reversal in Bitcoin. While the break on the given day looked positive. In retrospective, at the weekly close he tweets that cites that the resistances are still intact. He tweeted,

Trendlines and boundary lines should be drawn in a manner that connects the most possible key chart points, even if it ignores some spindles. pic.twitter.com/QxBJsCSuPJ

— Peter Brandt (@PeterLBrandt) January 13, 2020

The overall projection remains to be positive. However, there are are resistances ahead before the channel is finally broke clean.

Hence, as updated in his recent Trading Bitcoin analysis by Tone Vays, Bitcoin [BTC] has in the ‘no trade zone’ with the bullish resistances and bearish support too close for massive moves on either side.

Where do you think the price is headed next? Please share your views with us.

Disclaimer The views, opinions, positions or strategies expressed by the authors and those providing comments are theirs alone, and do not necessarily reflect the views, opinions, positions or strategies of CoinGape. Do your market research before investing in cryptocurrencies. The author or publication does not hold any responsibility for your personal financial loss.

Nivesh from Engineering Background is a full-time Crypto Analyst at Coingape. He is an atheist who believes in love and cultural diversity. He believes that Cryptocurrency is a necessity to deter corruption. He holds small amounts of cryptocurrencies. Faith and fear are two sides of the same coin. Follow him on Twitter at @nivishoes or mail him at nivesh(at)coingape.com

read more