Coingape - 11/5/2019 8:53:30 AM - GMT (+0 )

The Bitcoin futures market is reawakening as the price boost at the end of October to over $10,000, saw the pioneer cryptocurrency grow by a mammoth 42% in less than 24 hours. Bakkt futures by the Intercontinental exchange (ICE) have followed suit with the number of open interest (OI) contracts reaching an all-time high value of $1.26 million as of Nov. 4. Furthermore, institutional grade futures from the Chicago Mercantile Exchange (CME) are growing in popularity as the number of OI contracts rose 383% since August.

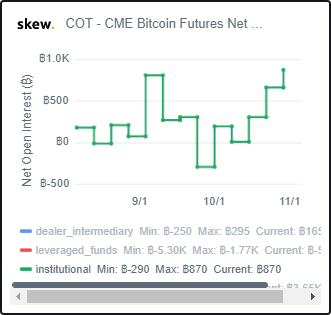

Institutional interest cannot be exclusively pinned to President Xi Jinping’s speech endorsing blockchain as the value has kept rising since then. Institutional interest in CME Futures saw a spike from 2,873 contracts in Q3 2018 to 5169 open contracts as of Nov. 4. Long BTC futures, in particular, have had a rocky ride through the past 3 months, starting at 180 contracts at the start of August and peaking at 805 contracts in September as BTC’s price dropped below $10,000 USD from its July highs.

As BTC struggled through September to cross the resistance at $10K, institutional interest in futures died down, turning long contracts to shorts – number of OI on BTC longs dropped to -290 BTC on September 24th. However, October presented a revamp in institutional interest as the value of long Bitcoin futures open interest on CME grew by 450% as the volatility of BTC spot price dropped to 6 month lows of 2% on Oct. 22.

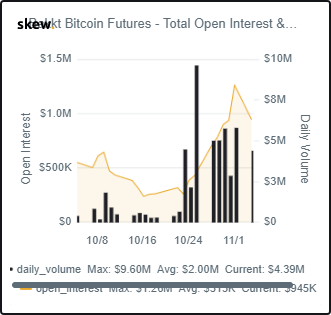

Image: Skew MarketsNovember has started on an even sweeter note as both CME and Bakkt futures experienced increased interest from large investors. Bakkt, a widely proclaimed “failure” is finally showing signals of success reaching almost $10 million in daily trades for physically settled BTC futures.

Bakkt Records All-Time High Open InterestIt is not only CME that has displayed the increased interest by institutional investors. As seen from data collated by Skew, Bakkt futures open interest recorded its highest value on Nov. 1 reaching $1.26 million USD with the daily volume traded at $5.76 million USD. The value of Bakkt BTC futures open interest has since dropped to $925K USD as of time of writing.

Source: Skew Markets A Possible Bear Momentum on BTC/USDDespite the increased interest from institutional investors, analyst predicts a possible reversal in BTC/USD price following a formation of a head and shoulders pattern. One analyst on Twitter, @cryptodude999 placed a short trade targeting $9000 region. He wrote on Twitter,

$BTC Quick update on the trade. Pretty decent. I'm not a fan of classical patterns on lower TF's but this head and shoulders played along nicely.

Closed a bit at the 25MA hourly which aligns with this level. Not flipping long but expecting something like this. Will add there. pic.twitter.com/IEAtSCidn2

— CryptoDude (@cryptodude999) November 5, 2019

Since the trade, a reversal from the $9,500 support level to $9,100 on BTC price is causing more analysts to call on a possible bear trend on price.

$BTC – Not looking great imo. Took highs above the Range High & Unable to close above.

If price bleeds back to the EQ with little to no bounce, there's a good argument to be made for a break of $9k on the horizon.

Highs taken… now it's off to the lows. #Bitcoin pic.twitter.com/CORBVA7EmM

— UB (@CryptoUB) November 5, 2019

Disclaimer The views, opinions, positions or strategies expressed by the authors and those providing comments are theirs alone, and do not necessarily reflect the views, opinions, positions or strategies of CoinGape. Do your market research before investing in cryptocurrencies. The author or publication does not hold any responsibility for your personal financial loss.

Been in the field since 2015 and he still love everything blockchain and crypto! FC Barcelona fan. Author and journalist. Follow him at @lujanodera.

read more