Coingape - 9/11/2019 9:57:30 AM - GMT (+0 )

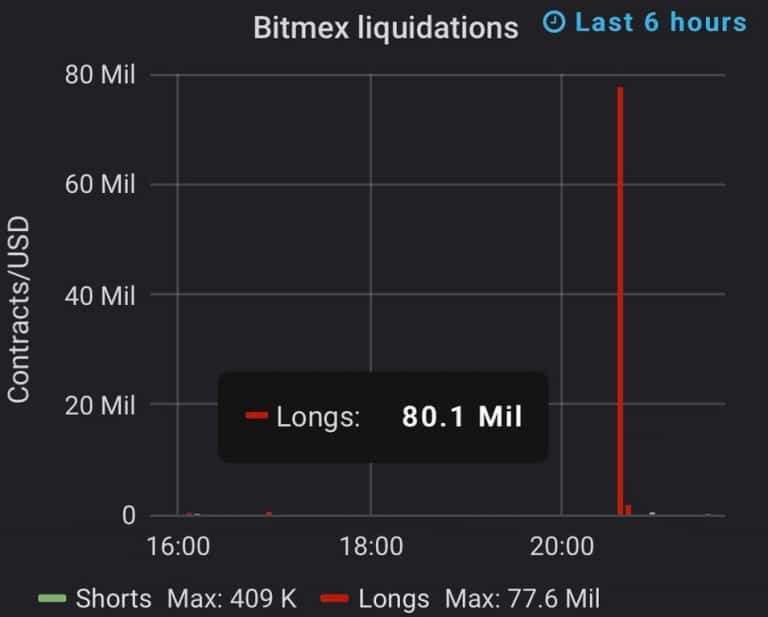

Bitcoin’s drop from $10,337 to an intra-day low of $10,027 has triggered $77 million in long liquidations on the crypto derivatives platform BitMEX.

Bitcoin Price Drop Responsible for LiquidationsPer a recent revelation by margin trading monitor Datamish, Bitcoin’s price fall has triggered $80.1 million in long liquidations on BitMEX.

Source-DatamishInterestingly, the previous week saw $3.5 million short contracts being liquidated and generating about 54% of the volume on the 2nd of September

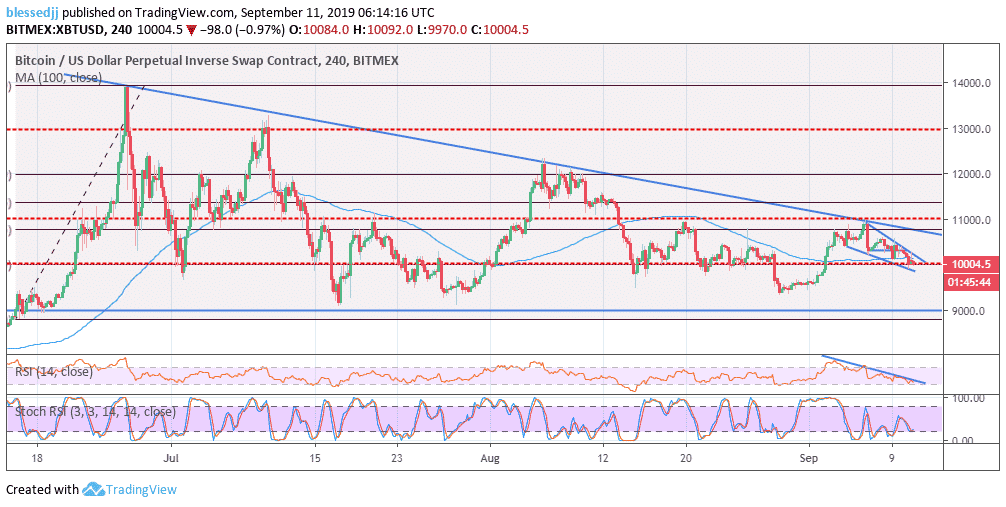

Source-DatamishFurthermore, observation of both the 4-hour chart for XBT/USD trading pair for the perpetual inverse swap contract on BitMEX clearly shows the formation of a falling wedge pattern. This implies Bitcoin has a high affinity to lower correction in the short-term.

XBT/USD Price Chart by TradingviewA recent study by Delphi Digital noted that the inflow of Bitcoin can be indicative of significant selling pressure. Interestingly, this was the case in early July, when Bitcoin prices dropped significantly after crypto exchanges received lots of deposits in Bitcoin.

A breakout above the $11,000 – $11,200 range for BTC could be the catalyst for another strong move higher. Conversely, a break below ~$9,400 may signal more pain ahead in the near term, though we’ve seen significant buying pressure in this range, evident in Bitcoin’s quick bounce off these levels in mid-to-late July and the end of August,”

said the firm.

Analysts Predict Bitcoin Price to Hit $9,000Chief investment officer, David Martin in an interview with Forbes said that Bitcoin’s 30-day volatility is now at around 53.50%.

“So far in September, Bitcoin’s price has continued the consolidation and range-bound nature that was kicked off early August. As of [Tuesday] morning, Bitcoin’s volatility is now at a four-month low of 53.5%, a level not seen since May 11th.”

Analyst Josh Rager says Bitcoin price can reach $9,000 in the short term if the bulls don’t have a solid comeback,

“Bitcoin price breaks through current support area on the daily and through the 20MA. If buyers don’t step in the next couple days, we’ll see Bitcoin retest the previous support in the low $9,000’s A break from there likely leads to $8,000.”

FXStreet’s Rajarshi Mitra said.

“There are two resistance levels on the upside at $10,280 and $10,450. On the downside, healthy support level lies at $10,080, which has the SMA 5, SMA 10, 1-day pivot point support 1, 15-min Bollinger band middle curve, 1-week Fibonacci 61.8% retracement level.”

The sudden spike in Bitcoin was attributed to the launch of Bakkt warehouse, post-launch the price has fallen considerably. It is likely that Bitcoin finds support at $9,800. If Bitcoin breaks the wedge pattern, it is soon likely to hit $12,000.

Coming from a physics background the unpredictability and intrigue of the cryptoverse attracted me to take a dive in this field. I am all eyes and ears for the latest trends in blockchain and crypto sphere. Whenever I am not writing or researching, I love to read sci-fi novels, play basketball and watch action movies. I strongly believe that blockchain and cryptocurrency will bring lasting transformations in people’s lives in the years to come. You can reach out to me at supriya [at] coingape.com.

read more