U.Today - 2/1/2026 2:16:43 PM - GMT (+0 )

Advertisement

February kicks off with trouble for XRP and Ethereum, but Cardano might be getting ready to surprise. XRP just lost a key technical level that now may lead to -77%. Ethereum got hit by a $242 million deposit from a whale that was present since the Satoshi era, right before its price slipped under $2,420.

But ADA? It is stepping into what has historically been its best month, and nobody is talking about it.

TL;DR- XRP loses monthly mid-Bollinger band, puts $0.37 downside on the menu.

- ETH drops 8.5% as 100,000 ETH worth $242.7 million lands on Binance from an old-school whale.

- ADA heads into February with a hidden +24.4% average return record.

XRP’s monthly chart just triggered a red flag as for the first time in over a year, it closed below its mid-Bollinger Band. To put it simply, it is a level that historically separates strength from weakness.

HOT Stories

Now as this happened the main scenario for the XRP price is to visit $0.37, which is 77% below the current price point.

Advertisement

The next big level to watch is the lower Bollinger Band, sitting down at $0.374. That is a long way from the current price of $1.64, but with bull momentum from 2024-2025 gone and bulls missing key support at $1.93, the chart bias flips without any argument.

What worsens the situation is that the signal is not just technical, it is psychological too. The mid-band on monthly Bollinger charts often acts as a confidence anchor for the long-term. Once the price breaks under it with a full candle close, trend traders flip defensive. That is what just happened.

XRP hit $3.60 at its peak in 2025, but has now lost over half of that value. And with no strong reversal signs in place, this looks like the slow bleeding will continue. Notably, this move mirrors the structure from the 2021-2022 breakdown, where the price slid from $1.90 to $0.30 over four brutal months.

Advertisement

Order book data also shows sell-side liquidity clustering around the $1.7-$1.75 zone, adding to upside rejection pressure. Unless buyers reclaim the $1.93 level fast and turn this whole dip into a fakeout, the lower band magnet could pull the price down toward $1.45, then $0.37.

Satoshi-era Bitcoin whale just dumped 100,000 ETH on BinanceOne of the oldest wallets on the blockchain tied to early Bitcoin mining days (from 2010-2011) dumped exactly 99,999 ETH — worth $242.7 million — straight into Binance a few minutes ago.

The wallet, tagged by Arkham as "BTC OG $BTC to $ETH," has been dormant for years. Now, suddenly, it is active again — and its first move is to drop a giant bag of ETH into an exchange hot wallet.

That move did not go in isolation. Ethereum fell over 8.5% in the past 24 hours and now trades at $2,411. The daily chart confirms a sell-off after breaking below the $2,700 zone earlier this week. No support is holding for now.

The whale’s entire portfolio still holds 472,643 ETH, along with 31,609 BTC valued at $2.49 billion, plus 180,827 AETHWETH and a few smaller altcoin exposures. But it is Ethereum that got hit, and hard.

The market has already been under pressure from ETF outflows and macro risk-off signals. A huge Binance inflow from a dormant OG wallet does not just trigger headlines — it triggers algo-driven spot and futures reactions. Multiple desks noted short positioning increasing minutes after the inflow alert went live.

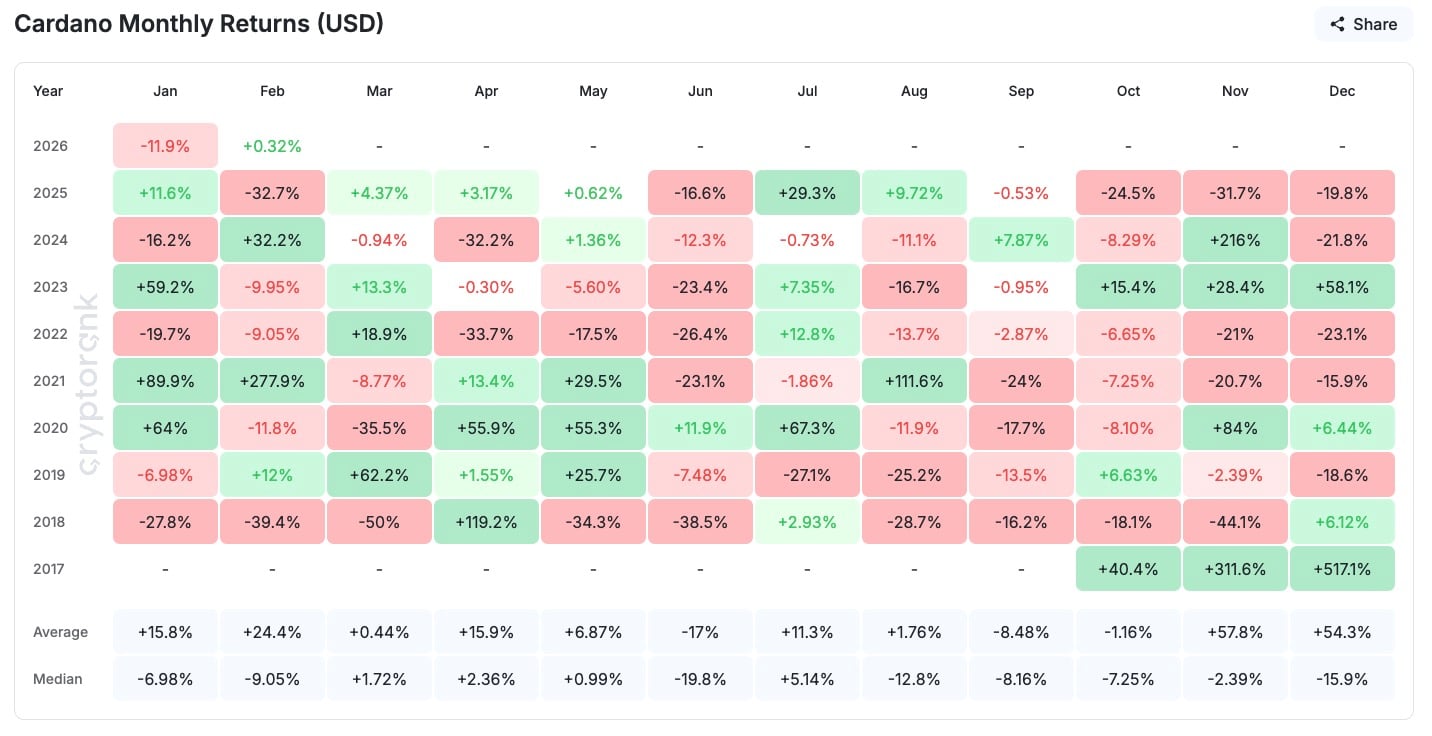

Cardano could outrun market in February, forgotten 25% record provesWhile the rest of the market froze in crypto winter vibes, Cardano might be on the verge of a bullish under-the-radar move. Looking at its price history by CryptoRank, February is one of ADA’s best months by far, with an average return of +24.4% and a monster +277.9% gain back in 2021.

For comparison: Ethereum’s median return in February is negative (-9.05%), and XRP’s is worse. Cardano, on the other hand, has a track record of delivering again and again in this particular month.

It started February with just a +0.12% uptick, but that is how past runs began too. Historically, the ADA price tends to follow BTC’s trend with a lag. So if Bitcoin stays range-bound, ADA might be the first to bounce.

The price action in ADA also tends to accelerate late in the month. In multiple years — 2021, 2023, 2024 — early February was flat or down before the price moved into a breakout pattern. That setup seems to be repeating.

This might be the best “quiet” setup in the top 20 right now. While ETH and XRP deal with panic, Cardano is drifting sideways into a month where it tends to wake up.

Crypto market outlook: Key levels to watch for XRP, BTC, ETH and ADAThe market’s tone right now is cautious, but not collapsed. Eyes are on whether XRP finds a lifeline or continues toward breakdown territory, if Ethereum’s whale dump is a one-off or a trend and whether Cardano finally gets its “flowers“ this month.

Things could shift mid-February if ETF flows return or if macro catalysts trigger renewed risk appetite. Until then, expect chop, a “crab market“ and isolated setups like ADA to stand out while the majors recalibrate.

- Bitcoin (BTC): at $78,777 with short-term resistance at $81,300 and support at $73,786. Keep in mind the $63,254 level, where Peter Brandt already set a flush target.

- Ethereum (ETH): at $2,411.69 with upside capped at $2,700 and a wider resistance line near the 200-day MA at $3,002. First support sits at $2,200, followed by $2,060 as a macro-level defense.

- XRP (XRP): at $1.64, having failed to reclaim the $1.93 mid-Bollinger line and with a key psychological resistance at $2.00. Structural support now at $1.45, with $0.374 as the monthly lower band target should the breakdown continue.

- Cardano (ADA): historical February setups point to +24.4% average returns. Resistance sits at $0.40, with breakout targets at $0.48 and $0.53. Closest support at $0.34. Watch for a late-month rally.

You Might Also Like

read more