Coindoo - 11/11/2025 11:04:44 AM - GMT (+0 )

- 11 November 2025

- |

- 13:04

At a time when the lines between traditional finance and digital assets are fading, Ripple Labs is positioning itself as a central bridge between the two.

Key Takeaways:

- Ripple is evolving into a financial infrastructure giant through multi-billion-dollar acquisitions.

- Institutional crypto adoption grows under a more supportive U.S. regulatory stance.

- XRP trades near $2.46 with short-term sell signals but a potential path toward $2.70.

- The Clarity Act’s delay and government shutdown continue to stall regulatory progress.

At the Swell 2025 conference in New York, CEO Brad Garlinghouse unveiled Ripple’s evolving mission: transforming from a blockchain innovator into a global financial infrastructure company.

In recent months, Ripple has intensified efforts to merge institutional-grade finance with blockchain technology, focusing on scalable solutions for banks, funds, and corporations seeking to modernize cross-border payments and liquidity systems.

Ripple’s Expanding Financial EmpireThe company’s acquisition trail this year underscores that ambition. Ripple acquired Hidden Road, a prime brokerage firm, for about $1.3 billion, followed by GTreasury, a corporate liquidity management platform, for over $1 billion. These moves culminated in the launch of Ripple Prime, a brokerage for over-the-counter spot trading of digital assets, alongside a $500 million fundraising round that lifted its market valuation to roughly $40 billion.

Ripple Labs is conquering crypto. Now the XRP-linked firm wants to take on traditional finance https://t.co/2bvm8kAdPW

— CNBC (@CNBC) November 10, 2025

Garlinghouse said Ripple’s goal is not to compete with banks but to embed blockchain directly into financial infrastructure. “We’re investing in the next generation of finance,” he explained, emphasizing that the company’s latest acquisitions are part of a broader plan to bring crypto-enabled efficiency to traditional markets.

Institutional Momentum and Regulatory ShiftsRipple’s expansion comes amid a friendlier environment for digital assets in the United States, where President Donald Trump’s administration has taken a more supportive stance toward the sector. The SEC and CFTC have scaled back enforcement, prompting a surge of institutional participation.

Banks such as Citigroup, JPMorgan, and Bank of America are developing blockchain-based products — from stablecoin custody to tokenized deposit systems — signaling a new era of collaboration between finance and crypto. Meanwhile, spot Bitcoin ETFs have continued attracting large inflows since early 2024, confirming Wall Street’s deepening involvement.

Garlinghouse noted that the U.S. is “finally leaning into crypto” after years of hesitation, calling the shift one of the most pivotal regulatory moments in the industry’s history.

Longest U.S. Shutdown Nears its End, but Crypto Shows No Reaction

Ripple is also pushing its XRP Ledger (XRPL) into broader institutional use. The company is in talks with major financial players to integrate XRPL technology into payment systems, enabling instant, low-cost settlements powered by XRP.

“The more we create real-world utility around XRP, the stronger the entire ecosystem becomes,” Garlinghouse said. While XRP has lagged behind Bitcoin and Ethereum this year, Ripple believes adoption through corporate integrations could be the catalyst for long-term growth.

Longest U.S. Shutdown Nears its End, but Crypto Shows No Reaction

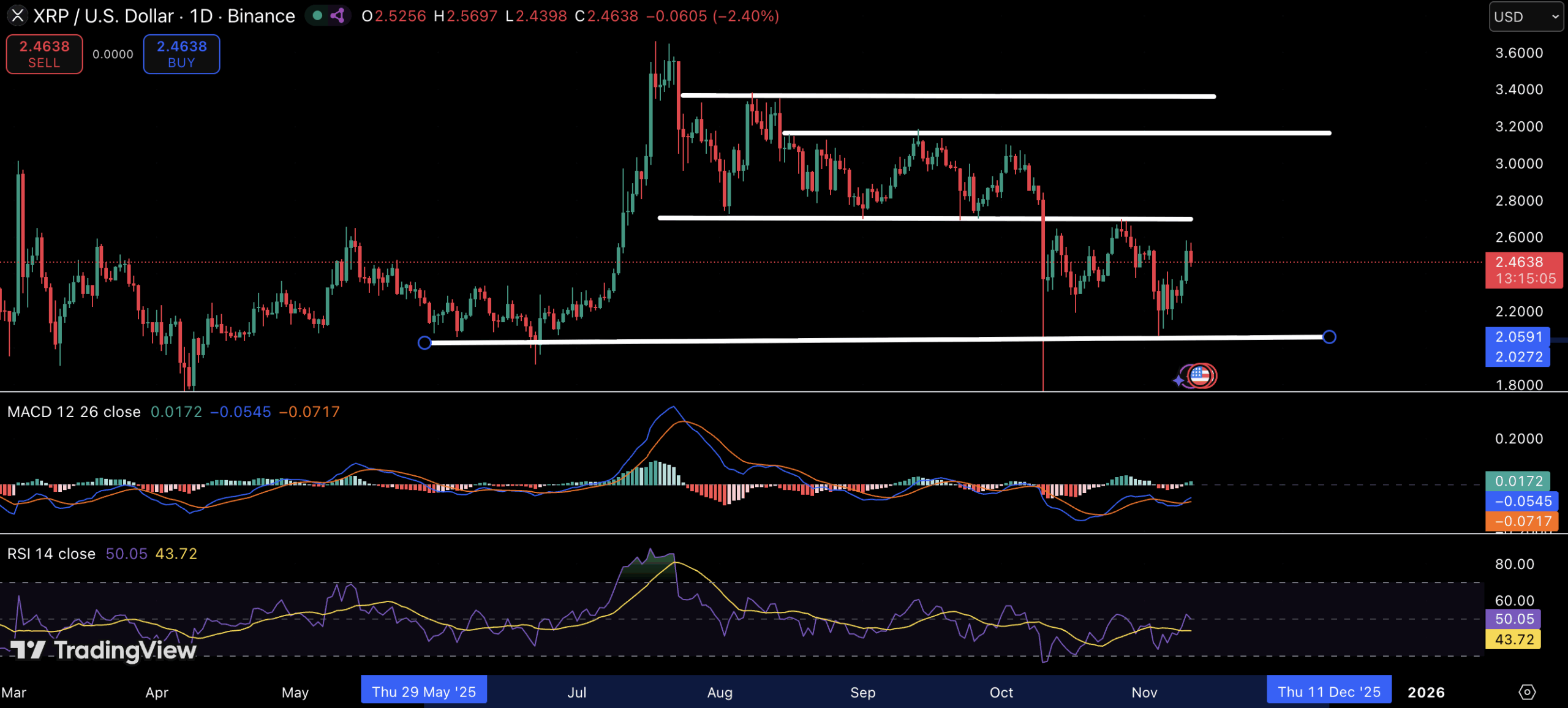

On the daily chart, XRP is currently consolidating around $2.46 after recovering from October’s lows. The price has established solid support near $2.00, a level that has repeatedly held through recent sell-offs. Overhead, resistance stands around $2.70, aligning with the September peak and serving as the next key breakout target.

Momentum indicators remain cautious — the MACD is turning slightly positive but lacks strong separation, while the RSI hovers near 50, suggesting a neutral market stance.

If bulls can sustain momentum above $2.50, a push toward $2.70 could materialize, but failure to hold current levels might drag XRP back toward $2. If the $2 support line doesn’t hold, a drop to the next support around $1.75 could be in the cards. For now, the trend leans sideways with mild bullish potential supported by improving sentiment around Ripple’s institutional expansion.

The Regulatory RoadblockDespite the progress, Ripple’s ambitions are tempered by Washington gridlock. The Clarity Act, designed to establish comprehensive digital asset regulations, remains stalled as the U.S. government shutdown drags into its sixth week. Without formal guidelines, banks remain hesitant to fully adopt blockchain-based financial products.

Garlinghouse acknowledged that progress will depend on regulatory clarity: “Financial institutions want to move forward — but they need the legal framework to do it.”

A Turning Point for Ripple and Crypto FinanceWith its expanding portfolio and a favorable policy backdrop, Ripple is edging closer to its long-standing goal: making blockchain the unseen backbone of global finance. If its institutional partnerships gain traction and regulatory clarity follows, Ripple’s transformation could mark a defining moment in how traditional finance adopts decentralized technology.

The information provided in this article is for educational purposes only and does not constitute financial, investment, or trading advice. Coindoo.com does not endorse or recommend any specific investment strategy or cryptocurrency. Always conduct your own research and consult with a licensed financial advisor before making any investment decisions.

Alexander Zdravkov is a person who always looks for the logic behind things. He has more than 3 years of experience in the crypto space, where he skillfully identifies new trends in the world of digital currencies. Whether providing in-depth analysis or daily reports on all topics, his deep understanding and enthusiasm for what he does make him a valuable member of the team.

read more