Coindoo - 10/20/2025 10:31:42 PM - GMT (+0 )

- 21 October 2025

- |

- 01:30

Bitcoin ETF outflows top $1.2B as BTC drops to $103,500 while Solana HYPE and MAGACOIN FINANCE attract investors.

Cryptocurrencies are experiencing turbulence with U.S. Spot Bitcoin ETFs reporting weekly outflows of more than $1.2 billion, topped by BlackRock IBIT. The fall in institutional inflows caused a sharp deflection in the price of Bitcoin, which pitched briefly down to $103,500 before recovering amidst the improvement of market sentiment.

Solana, Hyperliquid (HYPE) and MAGACOIN FINANCE are emerging as investor destinations as investors flock to undervalued assets that are poised to recover.

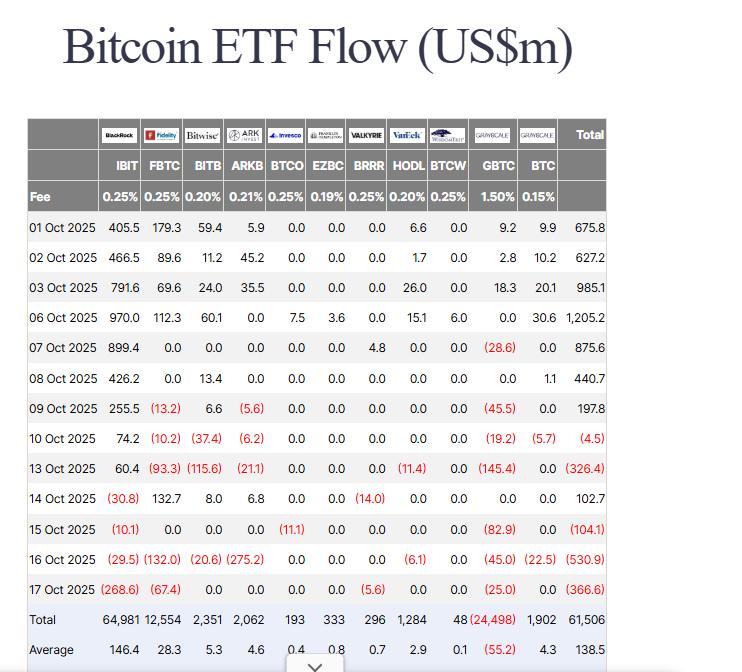

Bitcoin ETF Outflows Signal Institutional CautionAccording to reports, Bitcoin ETFs have experienced steep outflows this week, indicating that institutional investors are withdrawing risk exposure. Farside Investors data showed that total ETF outflows stood at $1.22B and that four out of five trading days experienced net withdrawals.

The highest outflow was on October 16 of $530.9 million and on October 17 of $366.6 million. On the same day, the iShares Bitcoin Trust (IBIT) of BlackRock alone had been subjected to redemptions in the tune of $268.6 million. Analysts attribute such withdrawal to caution of large holders following the recent selloff of the market.

Source: Farside data

Nonetheless, Bitcoin recovered marginally after U.S. President Donald Trump toned down his attitude towards China tariffs. The first risk of 100% tariffs on Chinese imports resulted in massive selling of international markets, including crypto. Nevertheless, there were indications of policy restraint, and BTC recovered above $111,000 in the course of session on Monday.

Solana Extends Recovery as Asia Event Boosts SentimentSolana price meanwhile stood above $192 following a good support at around $174 last week. With this consolidation, analysts anticipate that Solana price will rally to $200 and even to$ 218 if the bullish momentum continues. The increased trading volume is as a result of the expectation before the next Accelerate Asia Pacific Accreditation Cooperation (APAC) in China.

Source: X

The event dedicated to advancing decentralized infrastructure is supposed to reflect the increasing influence of Solana on the ecosystem of DePIN in the region. Based on the official post of Solana, he says that the Asia-Pacific market possesses fertile grounds that can be used to grow its DePIN and Solana has acquired some high-quality projects.

According to Santiment data, the total ecosystem trading volume of Solana topped 220 million on Saturday, the highest since January. This is a sign of increased network activity and a restored investor confidence in the medium-term prospects of Solana.

Hyperliquid Faces Key Test as Traders Watch $34–$36 ZoneConcurrently, Hyperliquid (HYPE) is converging in a small channel, with support at $34 to $36. According to market analysts, the latest reversal out of the $45 resistance level resulted in the traders taking a reserved stance, although the values of the RSI indicate slightly over-sold markets.

According to market data, once HYPE can reclaim the $38-$40 level in strength, it may be the beginning of fresh upside momentum. In the meantime, the analysts are keeping an eye on the $32-$34 range as one of the most important short-term stability areas. When this level breaks, then the next possible level of support might happen at around $28 according to Fibonacci retracement.

Source: X

The total open interest of Hyperliquid has reduced by more than 50% since October 9, dropping to $7.2 billion, compared to $15.1 billion. The fall signifies a cooling-off attitude among traders but also signals prospects of buying at lower prices.

MAGACOIN FINANCE Gains Momentum as Investors Seek New OpportunitiesMAGACOIN FINANCE is gaining traction across the crypto market as its presale passes the $16.5 million mark of commitments, and more than 15,000 investors have already joined in. The rapid pace of the project price, which continues to trade below $0.1, is creating a sense of urgency among traders that do not want to miss the last pre-listing window as many are calling it.

According to people familiar with the team, negotiations with some of the highest-ranking centralized exchanges (CEXs) are currently in the pipeline, and the next big goal is the public exchange listing. Upon entering these exchanges, the token will be made available to the first millions of users worldwide, the first time–and price discovery and mainstream exposure will become possible.

The analysts indicate that there is good upside potential in the early participants after trading becomes live, due to an improved liquidity and accessibility. One industry analyst observed, “Exchange listings are when a presale becomes a market. That is when the world realizes the true value of the token.”

The rush to the allocations before listings become public is so intense that on-chain data indicates that the inflows in wallets are increasing every hour. Community channels on both X and Telegram have gone wild with the sentiment, as more people start to believe that MAGACOIN FINANCE may be the next big breakout token of 2025.

Market Outlook as Traders Position for a 2025 RecoveryThe crypto market is stabilizing in spite of the volatility recently. The minor recovery of Bitcoin following the selling spurt of Bitcoins due to tariff restrictions indicates that there might be reduction in the panic of the macro. Meanwhile, Solana, HYPE, and MAGACOIN FINANCE are picking up as investors discover assets that have good fundamentals and ecosystems.

Analysts believe that there will be more large-cap to mid-cap rotation in the weeks to come. The ETF activity, the increase of on-chain volume, and the escalation of presale participation are forming a positive perspective. With a possible market turnaround coming, Solana, HYPE, and MAGACOIN FINANCE are being considered as the top crypto to buy before the next market run in 2025.

To learn more about MAGACOIN FINANCE, visit:

Website: https://magacoinfinance.com

Access: https://magacoinfinance.com/access

Twitter/X: https://x.com/magacoinfinance

Telegram: https://t.me/magacoinfinance

This publication is sponsored. Coindoo does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or any other materials on this page. Readers are encouraged to conduct their own research before engaging in any cryptocurrency-related actions. Coindoo will not be liable, directly or indirectly, for any damages or losses resulting from the use of or reliance on any content, goods, or services mentioned. Always do your own research.

Reporter at Coindoo

Krasimir Rusev is a journalist with many years of experience in covering cryptocurrencies and financial markets. He specializes in analysis, news, and forecasts for digital assets, providing readers with in-depth and reliable information on the latest market trends. His expertise and professionalism make him a valuable source of information for investors, traders, and anyone who follows the dynamics of the crypto world.

read more