Coindoo - 6/27/2025 8:34:01 AM - GMT (+0 )

Ethereum traders are piling into short positions at unprecedented levels, signaling the potential for a powerful short squeeze that could jolt ETH prices upward.

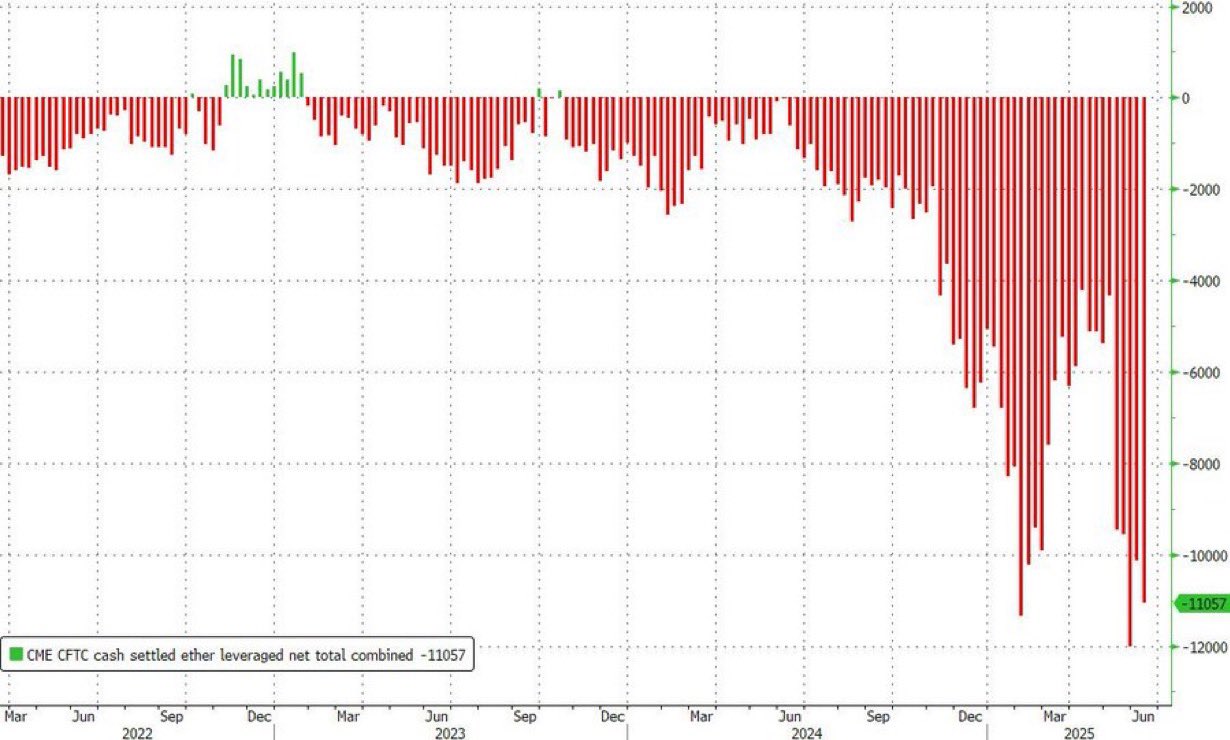

According to recent data from the CFTC cash-settled Ethereum futures market, net leveraged short positions have reached an all-time high of 11,057 contracts. The chart shows a dramatic surge in bearish bets, eclipsing any previous levels seen in the past three years. Market watchers are now eyeing this extreme positioning as a possible setup for a reversal.

While the broader sentiment leans heavily negative, the sheer scale of the short exposure could leave many traders vulnerable. If the price begins to climb, forced liquidations could trigger a cascade of buybacks, sending ETH sharply higher in a short squeeze scenario.

However, Ethereum’s price action has yet to reflect any bullish momentum. ETH is currently trading at $2,440, down 2.15% over the past 24 hours and nearly 5% on the week. Its market cap stands at $294.5 billion, with 24-hour trading volume declining 15% to $16.8 billion — suggesting reduced participation and possible trader fatigue.

Key Points:- Net leveraged short positions on ETH have hit a record high of 11,057 contracts.

- Market sentiment is overwhelmingly bearish, raising the odds of a short squeeze.

- ETH is struggling near $2,440, with trading volume down significantly.

- A sudden bullish trigger could ignite a wave of liquidations and upward price pressure.

With bearish bets stacked to the extreme, Ethereum appears to be approaching a critical juncture. If the market finds a bullish catalyst — whether from macro news, network developments, or broader crypto momentum — the reaction could be swift and violent. Until then, traders remain on edge, watching for any sign of a reversal in what could become one of the most volatile setups of the quarter.

Alexander Stefanov

Reporter at Coindoo

Alex is an experienced finance journalist and a cryptocurrency and blockchain enthusiast. With over 8 years of experience covering the crypto, blockchain and fintech industries, he deeply understands the complex and constantly evolving world of digital assets. His insightful and thought-provoking articles provide readers with a clear picture of the latest developments and trends in the market. His passionate approach allows him to break down complex ideas into accessible and insightful content. Follow up on his content to be up to date with the most important trends and topics.

read more