Coingape - 3/12/2020 8:53:09 PM - GMT (+0 )

If today’s price action guides, MakerDAO (MKR) posted the highest one-day loss in its short history.

The Ethereum-based token almost halved, dropping by 47% in the past trading day, consequently posting a new two-year low and fresh 2020 lows.

At $252 a pop, MKR’s severe self-off was triggered by the inevitable: liquidation and made worse by an auction glitch.

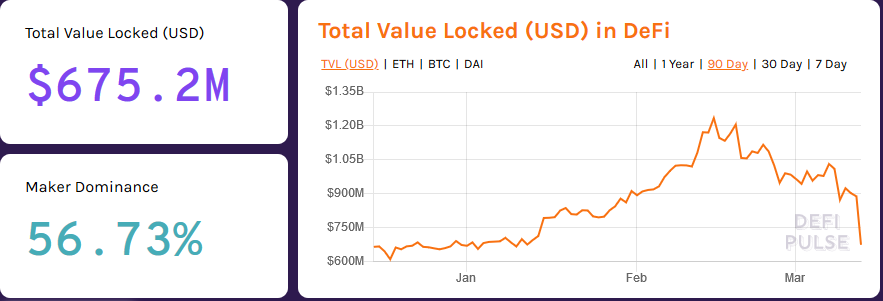

Maker MKR Market Performance MakerDAO and DeFi MakerDAO DominanceMakerDAO is the face of DeFi, an innovation where owners of Ethereum (ETH) can lend and borrow funds in DAI. It is a stable coin that is also, because of increasing liquidation, is trading at a premium of $1.02.

For each Collateralized Debt Position (CDP), a user must maintain a 150% collateral (in ETH) for what he/she borrows partly because of collateral’s volatility.

But, ETH has been on a free fall in the last week, the coin, though perched at second, is down 25% from 2020’s highs of around $280 to $137 at the time of press.

Analysts now say the coin could even crater to $100 is the current meltdown triggered in part by coronavirus continues.

Ethereum (ETH) LiquidationDropping ETH prices mean liquidation as the amount of collateral securing borrowed loans is not enough.

This then causes the smart contract to execute, and the result is liquidation—as the collateral is auctioned because of under-collateralization, and a liquidation fee for the debt holder is charged.

However, the situation was made worse a while back because Ethereum, as noted, was congested.

The Auction ExploitTaking advantage of this situation—and further fueling MKR price slide, were individuals bidding at 0 at these automated open market auctions and them receiving collateral for free because they were the only ones bidding—a liquidity concern that the Maker Foundation allegedly failed to stem despite their awareness of the massive liquidation as ETH fell.

Subsequently, as a Redditor discovered, between $4 and $8 million was stolen because of this “system failure” and the total lack of competition in the auction market.

The result “lack of liquidity” or absence of participation affected MKR holders only, not CDP holders because this “system exploit” saw collateral being dished out for free.

MKR fall is highly likely disproportionate and a swift correction may provide the foundation for a much-desired pullback.

Disclaimer The views, opinions, positions or strategies expressed by the authors and those providing comments are theirs alone, and do not necessarily reflect the views, opinions, positions or strategies of CoinGape. Do your market research before investing in cryptocurrencies. The author or publication does not hold any responsibility for your personal financial loss.

Dalmas is a very active cryptocurrency content creator and highly regarded technical analyst. He’s passionate about blockchain technology and the futuristic potential of cryptocurrencies and enjoys the opportunity to help educate bitcoin enthusiasts through his writing insights and coin price chart analysis. Follow him at @dalmas_ngetich

read more