Coingape - 1/13/2020 10:08:14 AM - GMT (+0 )

Decentralized Finance (DeFi) lending rose 2.1X in 2019 but the value of secured by DeFi applications may surge to $100 billion by the end of the year according to bullish observers.

DeFi, or simply, open finance has taken center stage in recent times with analysts and enthusiasts confident that the proliferation of blockchain-based financial products is on the course of replacing heavily regulated traditional financial products.

The Rise and Rise of DeFiChainlink is securing 9 figures of, publicly known, on-chain value today.

I have an inclination we will see this increase by 20-100x in 2020.

Decentralized derivatives will be driving this trend.

Yes, “defi” will be a 100 billion gorilla very soon. < 5 years.

— ⛓🐂 (@ChainlinkBull) December 27, 2019

Initially, the aim of cryptocurrencies was to enable the smooth transfer of value without middlemen. DeFi takes that a little step further by allowing users of crypto to lend and borrow coins and so much more automatically, globally, and without paper work. Upon launch, any dapp is global since they operate straight from a distributed ledger controlled by distributed nodes.

To get a clear grasp, DeFi is a general term that refers to “the digital assets and financial smart contracts, protocols, and decentralized applications (dapps) built on Ethereum.”

However, DeFi dapps are not only built in Ethereum but in other public chains as well. EOS, Waves, Tron and competing blockchains fitted with smart contracting capabilities can be a launching pad for DeFi apps. All it takes is awareness and marketing just like they would in traditional setups.

Basically, crypto loans are collaterized by digital assets and secured by a smart contract. Meanwhile, the interest rate is determined by the amount of security deposited, that is, the collateral. Often, these loans are over-collateralized because of crypto’s volatility.

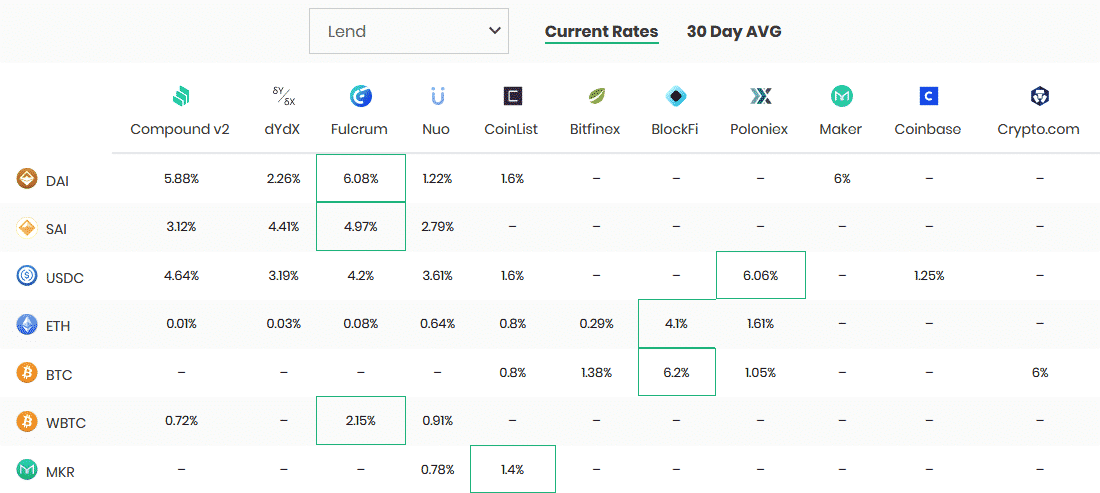

Maker Dominant while Lending Rates are Above MarketAt the time of press, Maker, is the dominant DeFi application. Lending out crypto in this platform returns on average 6% while a borrower will pay 5.7%. However, the most attractive platform to lend funds from is Fulcrum drawing 6% and 4% respectively to lend out DAI and SAI—both stable coins, respectively. You can lend out BTC with an interest at 6%, and ETH at 4% at BlockFi.

DeFi Crypto Lending RatesA borrower will have to pay a 7% interest to borrow DAI from Fulcrum, and 10% for USDC from Compound.

DeFi Crypto Borrowing Rates DeFi a Load of BSNonetheless, DeFi as a whole would expand if loans are under-collaterized as volatility taper. Presently, the over- collateralization is a problem for small business who would love to borrow but impeded by the high collateral requirements.

Despite what DeFi represents, one user now says the field is a “load of BS” that will soon collapse because of unsustainable returns:

“Personally, I think that DeFi is a load of bs that will collapse due to unsustainable returns, but in the meantime, it might continue to have some exceptional growth until reality sets in.”

Personally I think that defi is a load of bs that will collapse due to unsustainable returns, but in the meanwhile it might continue to have some exceptional growth until reality sets in.

— Billy Birdy🍓🍓🍓 (@Billy1Birdy) January 13, 2020

Disclaimer The views, opinions, positions or strategies expressed by the authors and those providing comments are theirs alone, and do not necessarily reflect the views, opinions, positions or strategies of CoinGape. Do your market research before investing in cryptocurrencies. The author or publication does not hold any responsibility for your personal financial loss.

Dalmas is a very active cryptocurrency content creator and highly regarded technical analyst. He’s passionate about blockchain technology and the futuristic potential of cryptocurrencies and enjoys the opportunity to help educate bitcoin enthusiasts through his writing insights and coin price chart analysis. Follow him at @dalmas_ngetich

read more